ATO Impersonation Scams

Have you, or someone you know, received a scary voice mail demanding immediate payment of a tax debt or risk a warrant being issued for immediate arrest?

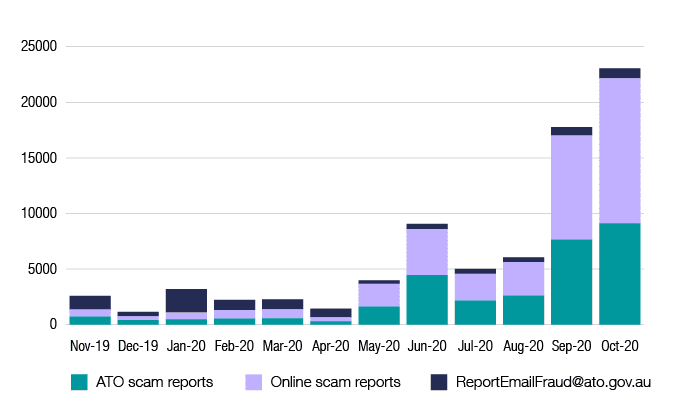

The latest ATO Scam impersonation report (October 2020) highlights the number of people scammed and the amount of money fleeced

- 9,113 scam reports were recorded via a dedicated phone line.

- 13,027 online scam reports received

- 585 phishing scam emails were reported to [email protected]

- $543,942 was reported as being paid to scammers

- Bank transfers recorded the highest amount paid $230,884

- Gift cards netted scammers $71,108

- iTunes and Google Play earned scammers a combined total of $115,480

Monthly comparison of reported ATO scams

The chart below highlights the monthly comparison of ATO impersonation scams.

Furthermore, 97% of ATO impersonation scams were conducted by phone, 2% by email and only 1% by text message.

ATO assistant commissioner Gavin Sierbert has issued an urgent warning highlighting the level of sophistication the scammers use. “Scammers are sending pre-recorded messages in record numbers and are manipulating caller identification so that your phone displays a legitimate ATO phone number despite coming from an overseas scammer”.

This particular technique is called caller ID spoofing or Robocall. Targets of this scam will receive a call demanding payment of a debt. If they miss the call, because the scammer has hacked a legitimate ATO number, when they call back it goes through to an ATO officer, which almost legitimises the scammer.

What is ID spoofing?

- Scammers use “robocall” technology to send pre-recorded messages. These messages demand payment for an existing tax debt and threaten immediate arrest.

- Despite calling from overseas, the scammers are able to manipulate the caller identification number to appear to be a legitimate ATO number.

- If you answer the phone call, the scammers will request payment of a tax debt. They will request payment via methods such as bitcoin, gift cards and vouchers.

- The scammers will use tactics such as intimidation, aggression, and threats of immediate arrest.

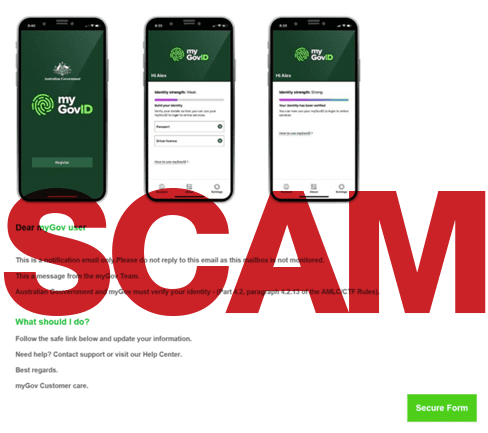

Latest ATO impersonation scam

With the increased use of the MyGov app due to COVID and the push to simplify obtaining personal information, it was only natural that a new ATO impersonation scam would develop involving the MyGov app.

The latest ATO impersonation scam is dated May 2021. Despite the stats above from October 2020, the latest scam is using email, asking people to update their MyGov or MyGovID details.

The ATO impersonation scammers are pretending to be from the MyGov customer care team and proceeding to ask people to verify their identity by clicking on the link provided.

An example of what is sent out is below:

If you receive an SMS or email that looks like it’s from myGov, but it contains a link or appears suspicious, you can report it to ScamWatchExternal Link. If you have clicked on a link or provided your personal information, you can contact Services Australia’s Scams and Identity Theft Helpdesk on 1800 941 126.

How to spot an ATO scammer

- Legitimate ATO calls do not show caller ID ( they come from a private number).

- Legitimate ATO calls do not use pre-recorded messages

- The ATO does not request payment through unusual methods like bitcoins, vouchers, or direct payment in personal accounts. Payment methods are listed on their website and you should always confirm the payment details are correct before paying any amount.

- The ATO will not send you an email or SMS asking you to click on any link. If you need to contact the ATO, independently search for their number to check if the contact is legitimate.

- The ATO will never harass or threaten you with immediate arrest, jail or deportation.

- They will never request a fee for release of debt owed by you.

- my.gov.au

- ato.gov.au

- the ATO app

7. You will get email or SMS notifications from myGov whenever there are new messages in your myGov Inbox. However, these messages will never include a link to log on to your myGov account. Always access our online services directly via one of the following:

-

- my.gov.au

- ato.gov.au

- the ATO app

8. When downloading the myGovID app, make sure it’s from either the Apple App Store or the Google Play Store.

Will the ATO leave a voicemail?

Absolutely not. The Australian taxation office will NEVER leave a pre-recorded or unsolicited voicemail, ever. If you receive any voicemail messages threatening to fine, arrest or investigate you – or making claims about your tax file number, delete them immediately. If a contact number or email address has been supplied, never call or email it. Remember, technology is often used to mask the scammer’s number by placing the ATO or other Australian number over it.

If in doubt, hang up. Then search for the ATO number on a letter or via the official government website and call them to check if they are looking to contact you.

How do you know if an ATO call is real?

The first thing to be aware of is that any legitimate call from the ATO will be private and display as ‘No caller ID’ on your mobile phone. If you are unsure, the best thing you can do is hang up immediately and call the official ATO number 1800 008 540 to verify if the call was genuine or not.

Does ATO ring on private number?

Yes. If you receive a call and the caller identity displays as ‘Australian Taxation Office’, it is not the ATO. All ATO contact is made via a private number, meaning anything other than this should be a red flag. However, it’s important to remember that the ATO NEVER makes unsolicited phone calls, so if you receive a call on a private number and they claim to be the ATO, hang up and call the ATO via the official number.

How to protect yourself from ATO impersonation scammers

- Know your tax affairs. Contact your tax agent or login to MyGov.

- Be identity theft savvy. Do not click on suspicious or unsolicited links. Do not share personal information on social media.

- If you are unsure about a call, text or email, you can verify the authenticity by calling 1800 008 540

- Only pay by legitimate methods. To check that a payment method is genuine, visit this link Verify Payment Methods

- Talk to your family and friends and ask for their opinion or let them know of your experience so you can help them too.

What to do if you have received a call or have been scammed?

- Call 1800 008 540 to report to the ATO if you or someone you know has been scammed or has provided personal identifying information to a scammer.

- If you have received a phone call but have not been scammed, fill in the online reporting form at this link – Report Scam Form

- If you have received an email or text message from scammers claiming to be ATO officers, forward the email or take a screenshot of the text and email [email protected]

- Delete the email or text.

- In the event of you having made a payment to a scammer, you will need to make a report to your local police.

- If you have given your credit card details to a scammer, you will need to contact your financial institution.

For more information

Report Cybercrime – Visit this link to report Cybercrime.

Consumer Fraud Information and Scam Reporting – Explore this link for consumer fraud information and to report other scams.

We are always here to help. Please feel free to contact us and ask for help.