How much tax you pay on a superannuation withdrawal depends on various factors. These include whether the payment has been made before or after your death. So, whilst this article isn’t intended to be an exhaustive list of how much tax you pay on a superannuation withdrawal, it should provide you with a reliable guide for some of the more typical circumstances.

When can you withdraw money from superannuation?

You can only draw money from superannuation if you satisfy a condition of release. A condition of release is defined by legislation and has specific tests needing to be met. Some of the more common conditions of release are:

- Retirement,

- Death,

- Reaching preservation age (refer below),

- Permanent or temporary incapacity,

- Severe financial hardship and/or

- Compassionate grounds.

How much tax do you pay on a superannuation withdrawal before a member’s death?

Once you’ve satisfied a condition of release, many factors will affect the rate of tax you pay on a superannuation withdrawal. These factors include:

a) The age of the person receiving the benefit. A person’s preservation age can impact the amount of tax and will vary depending upon when they were born. A person born before 1 July 1960 will have a preservation age of 55, whereas a person born after 30 June 1964 will have a preservation age of 60. For further information about determining a person’s preservation age, follow this link: When you can access your super | Australian Taxation Office (ato.gov.au).

b) The nature of the benefit (lump sum or income stream). A lump sum is one or more payments from a superannuation fund, whereby an application is made to withdraw a single amount for each payment. In contrast, an income stream is typically a series of regular payments paid at least annually.

c ) The components of the benefit (tax-free or taxable). The superannuation fund determines the taxable and tax-free parts of a person’s superannuation interest. It will be impacted by the type of contributions made to the superannuation fund over time. For further information relating to calculating the taxable and tax-free components of superannuation interest, follow this link: Calculating components of a super benefit | Australian Taxation Office (ato.gov.au).

d) The components of the taxable part (taxed or untaxed elements). The superannuation fund determines the parts which are taxed and untaxed of a person’s superannuation interest. Factors impacting these elements are:

- Superannuation benefits accumulated from specific public sector superannuation schemes and/or

- Where life insurance premiums have been claimed and a lump sum death benefit is paid.

For further information relating to calculating the taxed and untaxed elements of the taxable component of superannuation interest, refer to the link in item c) above.

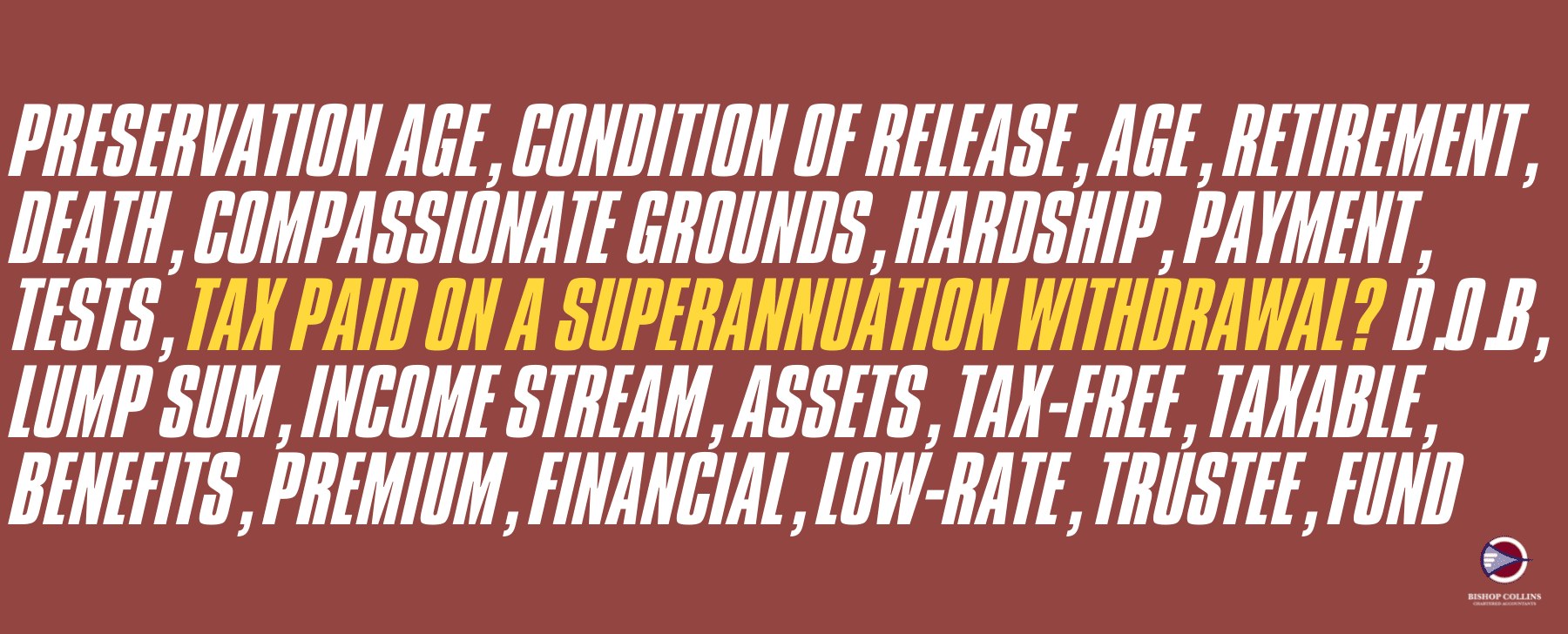

The table below summarises how much tax you pay on taxed superannuation withdrawn:

Tax on the taxed element of a superannuation withdrawal.

Note: The low-rate cap amount is $225,000 for the 2022 financial year. It’s a lifetime limit, which applies concessional tax treatment to the taxable component of any lump sum payments you receive between your preservation age and age 60.

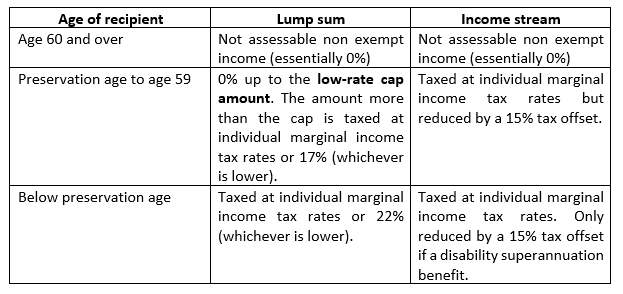

The table below summarises how much tax you pay on a superannuation withdrawal for the untaxed element.

Tax on the untaxed element of a superannuation withdrawal.

Note: The untaxed cap plan amount is $1,615,000 for the 2022 financial year. There may also be additional consequences if the income stream is capped with a defined benefit income which exceeds the defined benefit income cap for the year.

The tax-free component of a superannuation withdrawal is not subject to tax in all instances.

Withdrawing money from superannuation following death

If a person passes away with money in superannuation, the superannuation fund’s trustee is obligated to pay a death benefit as soon as practicable after the member dies.

The trustee generally only pays a death benefit to one or more of the deceased member’s dependents, or their estate, per the trust deed. The law defines a deceased member’s dependents. These include their spouse, child, or someone with whom the member has an interdependency relationship.

Interestingly, the definition of dependent for income tax purposes is slightly different. The critical difference is a child of any age can be a dependent for superannuation purposes. However, only a child under 18 can be a dependent for taxation purposes (assuming there’s no relationship of interdependency for a child over 18).

How much tax do you pay on a superannuation withdrawal after a member’s death?

The taxation consequences arising from a superannuation withdrawal after a member’s death will depend on many factors. Some of these factors include:

- Ages of the deceased and the recipient.

- The nature of the benefit.

- Components of the benefit.

- The elements of the taxable component; and

- Whether the payment is made to a dependent or non-dependent for income tax purposes.

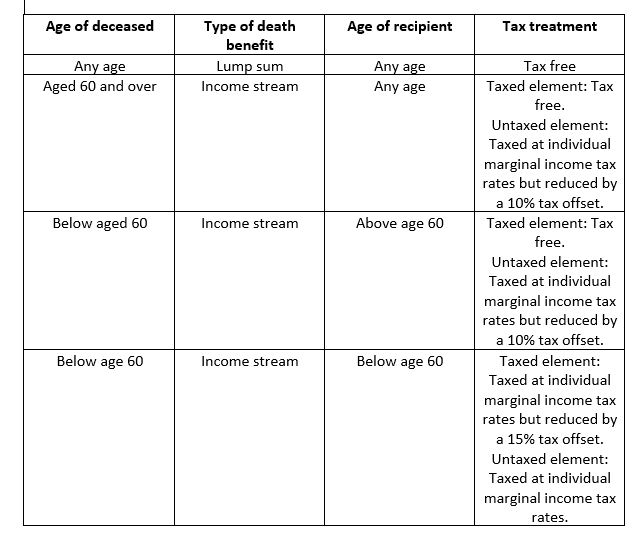

The table below summarises how much tax you pay on a superannuation withdrawal for a death benefit payment to a dependent:

Tax on death benefit payments to a dependent

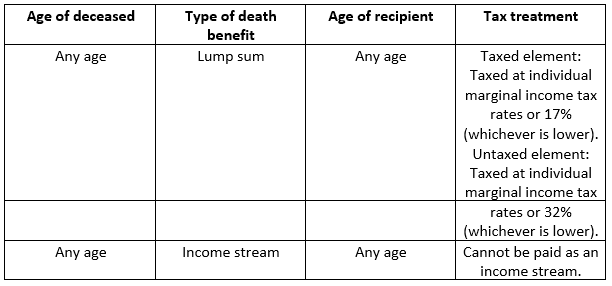

The table below summarises how much tax you pay on a superannuation withdrawal for a death benefit payment to a non-dependent:

Tax on death benefit payments to a non-dependent.

The tax-free component of a death benefit payment is not subject to tax in all instances.

The amount of tax you pay on a superannuation withdrawal is impacted by various factors unique to your circumstances. For this reason, it’s best to seek advice before making any withdrawals from superannuation.