So you’re here to find out how to reduce tax in Australia and reduce your taxable income?

Before I give you all the answers you are looking for to reduce tax in Australia, I’d like to share some of my favourite quotes to help to set the mood and provide some insight into what others think about taxes. Here are two of my favourites from two very significant heads of government.

“Taxes, after all, are dues that we pay for the privileges of membership in an organised society.”

Franklin D Roosevelt, former US President.

“For a nation to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle”

Winston Churchill, Former UK Prime Minister

I would say that the lessons from these two very different statements are that we need to pay taxes to support an organised society but to tax in excess is foolish.

We live within the laws that are provided to us but do not want to pay more tax than we need to legally. Knowing your rights and what you can do to pay less tax, reduce tax in Australia and maximise your wealth is both ethical and smart so let us begin with my first warning….

Illegal tax minimisation

Word of WARNING: There is a very powerful general anti-avoidance provision in Australian income tax law known as PART IVA. Generally, this provision applies if the dominant or sole purpose of a participant acting in a scheme is to avoid or reduce tax. The result of this is that the commissioner of Taxation can then cancel the relevant tax benefit and issue penalties.

So, if you’re thinking of opening an offshore account, lodging incorrect or fraudulent returns and participating in elaborate tax avoidance schemes, this will NEVER be a sound strategy.

Clever tax minimisation

Our top tax planning strategies come in three main focus areas and these should be discussed with a qualified and experienced tax accountant:

-

Structure, Structure, Structure

-

Timing is key – Before year-end review your tax position and act.

-

Know what Tax benefits are available.

1. Structure, Structure, Structure

Before you launch your next business, investment or job opportunity, work out which structure is best for you to operate or invest through. Is it a Company or a Trust, or as an Individual or a Partnership or maybe even through your Self-Managed Super Fund?

Consider the tax rate applied to taxable income amongst each entity. The individual and the partnership is from 0% to 47%, the company rate is either 25% or 30%. The rate for Trust’s is from 0% to 47%, and the Self-Managed Superfund is either 10% for capital gains or 15% otherwise.

There is a myriad of rules and regulations for each entity which allow for combinations of the entities to be used to maximise tax benefits. I love examples so let’s use one:

Example – Kelly earns a $230,000 salary annually and has 2 children of the adult ages of 19yo and 18yo. Both children are studying and will continue education for another 5 years. Kelly also has a partner who earns a salary of $180,000 pa.

Kelly and her partner are wanting to make a property investment, which they estimated to provide a net profit of $30,000 each year and a Capital Gain of $500,000 in 5 years. The children’s education and upkeep are expected to cost an estimated $300,000 over the next 5 years.

Their very wise advisors recommend purchasing their investment property in a Discretionary Family Trust with all family members as beneficiaries.

What is a Discretionary Trust? A Discretionary Trust allows the Trustee to distribute any taxable income to beneficiaries at their discretion. The Trustee can then utilise lower marginal tax rates of the beneficiaries and therefore reduce the total tax liability.

Every year the trust distributes $15,000 to each of the 2 children to pay for part of their living costs and education with both children receiving no other income. At the start of the 5th year, they sell the investment property and the Capital Gain of the property is $480,000. Half of this, or $240,000, is then distributed to each child. Kelly and her partner are earning more than 5 years ago.

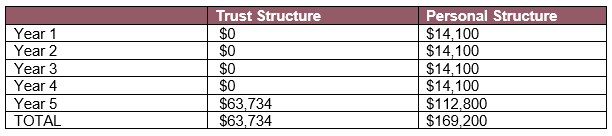

Assuming rates do not change, the net tax the family pays on the trust distributions over the 5 years, with private health insurance, and ignoring any tax offsets, compared to purchasing in the parent’s own names as a partnership is:

This is a net saving in tax of $105,466 over the 5 years.

However, there is one other tax that we must consider, and that is Land Tax. As the investment property is held in a Family trust there is no tax-free threshold, so 1.6% of the Land value is charged. Assuming the land value is $500,000 over the 5 years, then the additional Land Tax is $8,000 annually, so a total of $40,000.

There is still a tax saving of around $65,466 over the 5 years to the entire family, which is quite significant.

The savings could be even greater if the investment was purchased within a Self-Managed Super Fund (SMSF) and the property sold when the fund was in the pension phase, as there would be no tax on the gains made in the super fund and would not be subject to Land Tax. All of this is providing the balance of each member in the fund is under $1.7 Million…… There are many rules to consider !!!

This example demonstrates the significant advantages of getting the structure correct and why the first step to a tax effective strategy is Structure, Structure, Structure.

There are several ways to restructure your interests to achieve significant, future tax savings and minimise risk. However, this can come at a cost and is complex and unique to every group and situation. Your experienced tax accountant, like those at Bishop Collins, will be able to offer suggestions and estimate costs to suit your situation to reduce tax in Australia.

2. Timing is key to pay less tax

The income tax year is broadly from 1st July to 30th June. This is the cut-off date so any income earned, or expenses incurred during this time are included in that year. This makes planning the timing of your taxable income and expenses a critical part of tax minimisation.

Before the year-end, we highly recommend that you approach an expert and get some tax planning completed to forecast your estimated tax position for the year. Once you have this you are then able to see if you need to action on any strategies to minimise your tax within the current year.

The following areas have been outlined as effective tax planning strategies which are time-critical:

Plan your income

Defer earning income until after June 30 where possible in order to avoid paying tax within the current financial year. This could involve planning projects to be delayed provided it doesn’t impact the business negatively. Remember, this only ‘kicks the can down the road’, however, this can be very effective if the current year’s income is high and the following year’s taxable income is expected to be low. Word of warning – do not complete the project and just hold off on sending your invoice. If the project is completed you are entitled to the income and therefore will be part of your taxable income.

Time the sale of assets

The time an asset such as investment, property, or a business, is sold is critical in taking advantage of several tax concessions. Here are just some to consider:

50% general exemption

When the sale of an asset will result in a Capital Gain, be sure the timing of the sale takes advantage of Capital Gains Tax (CGT) concessions.

There is a CGT discount of 50% on assets that are held for more than 12 months. Please be aware that a sale of property takes place in the year you sign the contract, not on the settlement day.

Apply the 15-year exemption

For owners of small business aged 55 or older who retire and have owned a business asset for at least 15 years, they may be exempt from paying CGT at all when they dispose of the asset.

Retirement exemption

For small business owners that own assets with significant Capital Gains outside of their super, should time the sale of the assets to reduce the amount of CGT.

There is a lifetime limit of $500,000 CGT exemption on the sale of an active business asset. For those who are under 55, the proceeds from the sale of the asset must be paid into a super fund or retirement savings account to be entitled to this exemption.

Pre-pay expenses

Prepaying up to 12 months of deductible expenses can bring the deduction forward to the current financial year. This may include prepaying interest on an investment loan.

3. Know what tax benefits are available

There is a range of options that may be available to assist in minimising tax. Let’s have look at some of the most common ones:

Superannuation contribution options

Salary sacrificing super contributions

Salary sacrificing into super involves sacrificing some of your salary/wages before tax and putting it into superannuation instead. This is a great tax-effective strategy because super contributions are taxed at the concessional rate of 15% in Australia. This is a lower rate than the personal income tax rate.

One other allowable tax deduction that can also be a significant wealth creation strategy over the long-term is maximising your voluntary superannuation contributions. You can claim up to $27,500 as a tax deduction in the financial year ended 30 June 2022. This is known as the concessional contributions cap.

Unused concessional cap carries forward

From 1 July 2018, you could be entitled to contribute the unused amounts of your concessional contributions cap for a maximum of 5 years.

As an example, if you didn’t pay any superannuation contributions for FY2019, FY 2020, and FY 2021 then you may be entitled to make deductible super contributions up to the value of $102,500 in FY 2022. This could save $48,175 in Tax for the FY2022 year.

Salary packaging in a charity

If you are working for a charity that has Fringe Benefits Tax (FBT) exemption, then you can save by having $15,900 of your living expenses paid tax-free, these include expenses such as:

- Rental payments

- Personal loan payment

- Mortgage payments

- Credit card payments/living expense cards

- General living expenses

- Utility bills or rates notices

Temporary full expensing and allowances

Are you carrying on a business with sales revenue of less than $50 million?

If so, if you buy new or second-hand assets before 30 June 2022, you’ll be eligible to claim a tax deduction for the full cost of the assets in the 2022 financial year.

This scheme is referred to as ‘temporary full expensing’. More generally known as the Instant Asset Write Off. It was introduced by the Government for assets bought after 6 October 2020 and will apply to assets first used or installed ready for use before 30 June 2023.

Before buying these assets, you should be aware that your tax deduction will be limited to the business use of the asset. Your tax deduction will also be limited to $60,733 if you buy a car during the 2022 financial year. For tax purposes, a car is broadly defined as a motor vehicle designed to carry fewer than nine passengers and a load of less than one tonne.

Take advantage of tax concessions that exist now – they may not be here forever! See your tax accountant for more details as there are many conditions applicable.

Claim for property depreciation

Most properties that generate income, tend to qualify for some level of depreciation to help reduce tax in Australia. Property investors can claim Division 43 capital works deduction and Division 40 plant and equipment depreciation. The capital works deduction applies to items that are fixed to a property’s structure which includes renovations. The plant and equipment deduction relates to what you can claim for eligible items within the property, curtains or blinds for example.

Use a quantity surveyor

What is a Quantity surveyor? Quantity surveyors help prepare a depreciation schedule to help maximise an investor’s claim for depreciation. The cost of preparing this report is also tax-deductible.

Did you know there is an unintended ‘Death Tax’ in Australia?

For dependants of a deceased member, super benefits paid on the death of a member are tax-free. However, some members are not survived by dependants, and are often survived by adult independent children who do not receive tax-free distributions. The taxable component of the lump-sum super death payment is usually subject to a 15% tax.

To minimise the chance of surviving adult children paying the ‘death tax’, members should consider using a recontribution strategy, keeping a separate pension or potentially even drawing down on their super before their passing. This means having clear instructions in the will and for any Power of Attorney in the event of incapacity. This means having clear instructions in the will and for any Power of Attorney in the event of incapacity.

Use your Franking Credits wisely

Use of Franking Credits in your tax planning can save you tax. This is achieved by utilising the tax paid by the company, which is passed on to the shareholder when a Franked Dividend is paid.

Franking credits can reduce the income tax paid on dividends or potentially be received as a tax refund.

Effective tax planning

This list is not exhaustive, and we highly recommend you talk to an experienced tax accountant, like those at Bishop Collins, as every person’s tax position is unique and requires consideration of a multitude of factors to design an effective tax plan to reduce tax in Australia.

If you would like to understand more about how you can reduce tax in Australia based on your circumstances, we would love to assist so get in touch.