Glenn Harris

Company Director

Issues impacting your superannuation

1 – Impacts of Taking Your Superannuation Early

Your superannuation takes a journey of many years. Not unlike the long journey of raising children, your superannuation savings will face many trials and tests during its journey, and even further challenges once you reach retirement (hopefully by then the children have left the nest).

The government’s announcement allowing Australians to participate in the “coronavirus early release of super” was met with an overwhelming response. Within 18 days, 745,000 people had registered via MyGov to access their superannuation early.

The Government estimates 1.6 million people will access their super early, withdrawing a staggering total of $27 billion from superannuation savings. The Australian superannuation industry believes this number will in fact be closer to $65 billion.

We would like to take this opportunity to urge caution when considering accessing your superannuation balance early. Depending on your age, a withdrawal of $20,000 from your superannuation may have a devastating impact on your superannuation balance at retirement.

Based on an annual net return of approximately 5%, we estimate the reduction in superannuation balance at a retirement age of 67, by withdrawing $20,000, may look something like this:

| Current Age | 20 | 30 | 40 | 50 | 60 |

| Reduction in retirement balance | $ 195,000 | $120,000 | $75,000 | $ 45,000 | $28,500 |

| Reduction in annual retirement income | $ 9,900 | $ 6,050 | $3,800 | $2,300 | $1,400 |

Investment returns may be further diminished from a smaller superannuation balance where you need to cover ongoing insurance premiums. By withdrawing the funds from superannuation, you will have also missed out on the significant taxation benefits of saving in the superannuation environment. Future legislative changes may also restrict your ability to ever be able to put the money back into superannuation.

Rather than withdrawing $20,000 from your superannuation, we suggest you consider alternative methods to manage your cash flow as part of the current crisis. This may include accessing your entitlement to government payments and discussing deferral of debt payments with your lenders.

In addition to this, we suggest you consider adding to your superannuation on a regular basis if your cash flow permits now or in the future. For as little as the price of a cup of coffee per day, an increase in superannuation contributions can have a significant impact on your retirement savings. This is illustrated in the case study below.

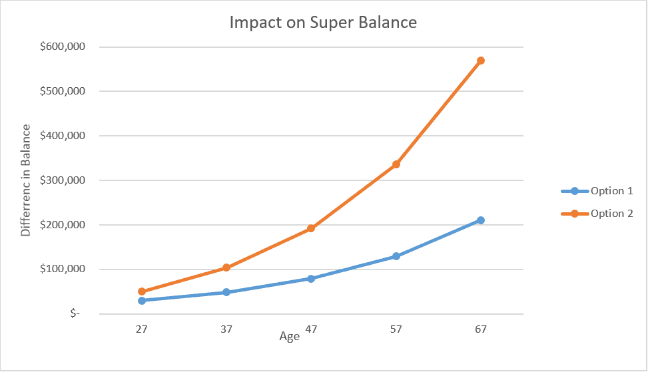

Case Study – ISSUES IMAPCTING YOUR SUPPERANUATION

Tony is currently 27 years of age and has a superannuation balance of $50,000. He is considering whether he should withdraw $20,000 from superannuation (option 1) even though he does not desperately need the cash at this time. After speaking with his financial advisor, Tony considered not withdrawing the $20,000 plus contributing a further $5 per day into superannuation ($1,800 per annum) (Option 2).

The following chart shows the difference in Tony’s superannuation balance between option 1 and option 2 when he retires:

By selecting Option 2 Tony will have more than $350,000 extra in his superannuation account on retirement than if he selected option 1.

The above example shows it is never too early to learn how your superannuation can work for you so that you can maintain your lifestyle in your retirement.

Issues impacting your superannuation

2 – Self-Managed Superannuation Fund Investment Strategies

We would like to highlight the importance of having a strong and consistent strategy when investing. If you are using or plan to use a Self-managed Superannuation Fund (SMSF), as trustee, you are responsible for developing and implementing this strategy.

Importance of a consistent Investment Strategy

A strategy provides a pathway and focus when it comes to making important decisions on where to invest your hard-earned wealth. Not unlike a professional athlete, focus, a clear plan and a consistent strategy is critical to success when it comes to investing and building wealth. If your pathway is unclear, it is likely you will change strategy too frequently, resulting in a poor long-term outcome.

Investors who attempt to “pick the market” have very little room for error. Consider the following Morning Star analysis. Investors who stayed in the market for the last 20 years (or 5,035 trading days) achieved a compound annual return of 6.1%. However, that same investment would have returned 2.4% had the investor missed only the 10 best days of stock returns.

Further, missing the 50 best days would have produced a loss of 5.5%. Although the market has exhibited volatility on a daily basis, over the long term, stock investors who stayed the course were rewarded.

Commercial considerations…

Using your SMSF as your investment vehicle offers numerous positive commercial outcomes. You will have full choice on individual investments. This may even include using gearing to acquire property or other investments. (e.g. Commercial property to be used by a related business). With this choice comes flexibility in changing investments depending on individual members’ circumstances, including having members in both accumulation and pension.

Taxation is a significant benefit of having your investment portfolio in an SMSF. Investment income and gains will be taxed at 15% and discounted capital gains at an effective rate of 10%. When your account balance is in the pension phase, your tax rate will drop to 0%.

The administration costs of an SMSF are fixed and not a percentage of the assets. This means as your fund grows, the administration costs decrease. Also, an SMSF provides transparency in relation to administration and other costs.

Compliance Considerations….

Using an SMSF also has significant compliance considerations. As recently as February this year, the ATO has provided further detailed guidance on what they expect to see from trustees of an SMSF regarding documented investment strategies. The days of a boiler plate “one size fits all” template for an investment strategy is unlikely to make the grade. The ATO has provided this guidance clearly to SMSF auditors. A breach could possibly result in a penalty of $4,200 on each trustee.

The ATO is not a prudential regulator and will therefore will not assess the merits of an SMSF investment strategy. However, The ATO will assess trustee compliance with the development and implementation of the investment strategy.

A properly formulated investment strategy is also a strong defence for the trustees and advisers, should investments fail, against potential actions that might be initiated by the ATO or others who have suffered a loss.

Should you require any further information in relation to your superannuation savings journey or the benefits and responsibilities of operating an SMSF please contact Phil Keenan [email protected]

Should you require support with your superannuation savings journey or to navigate through the requirements to access your entitlement to government incentive payments please contact us at Bishop Collins on (02) 4353 2333.