Who is going to benefit? How will it affect you?

On Tuesday the 29 March 2022 at 7:30pm the Federal Treasurer presented the Australian Federal Budget 2022-23 and we wanted to provide you with our summary.

In the Federal Budget 2022, there was an update on how Australia has fared compared to the rest of the world and is always an interesting performance marker to consider.

Australia’s recovery is one of the fastest in the world – faster and stronger than the United States, the United Kingdom, Canada, France, Germany, Italy and Japan. The unemployment rate was confirmed at 4 per cent which is the equal lowest in 48 years and forecast to drop to 3.75%.

The expected Australian Federal Budget deficit for 2022-23 is estimated at $78.9 billion but over 5 years $103 billion better compared to last years budget. Over the 5 year forward estimates the estimated deficits will total almost $225 Billion. Ouch !!!!! This has been left for another time to deal with.

The argument from the treasurer is that due to international uncertainties and pressure on the cost of living something must be done now. Possibly to stave off a potential drop in consumer confidence and balance the risk of damaging inflation.

The following key provisions in the Federal Budget 2022 provide cost of living relief:

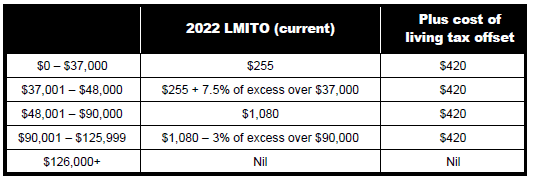

- an increased Low and Middle Income Tax Offset in the 2021-22 year of $420 will bring the maximum offset to $1,500. This will be received once individuals lodge their tax returns and only if they have paid tax,

- a one off $250 payment will be made to individuals who are currently in receipt of Australian government social security payments, including pensions.

- from 30 March 22 a 6-month fuel excise relief of 50% which equates to a 22cent per litre saving

The concern that these stimulus measures will contribute to inflation was countered by the argument that the reduction in the fuel excise has a cascading effect of reducing input costs for the production of goods and services and therefore should be deflationary.

Business support includes the following key measures:

- Technology Investment Boost – Small and medium businesses that turnover less than $50Million will be able to deduct an additional 20% of eligible expenditure supporting digital adoption up till 30 June 2023.

- Skills Investment Boost – Small and medium businesses with less than $50Million in turnover will be able to deduct an additional 20% of expenditure incurred on external training courses provided to their employees up till 30 June 2024.

For Example: if you spend $1000 on cyber security or subscription you can claim $1200 as a deduction on your tax return.

We have broken the Australian Federal Budget 2022 all down for you by Individual, Business, Superannuation and Tax Administration Efficiency.

There are also a range of spending measures in infrastructure, health, education, defence Government assistance for floods and other measures which have not been included in our summary.

Please refer to the budget website for a more detailed analysis of the budget.

Federal Budget For Individuals

In addition to the cost of living relief mentioned in the introduction, there will also be the following provisions:

- A From 1 July 2022, the Government is again reducing the PBS Safety Net thresholds. As a result, patients will reach the safety net with around 12 fewer scripts for concessional patients and two fewer scripts for general patients in a calendar year.

- Additional funding for managing the impacts of the COVID-19 pandemic will be provided over 5 years to support older Australians in the aged care sector.

- As previously mentioned by the government the costs of taking a COVID-19 test to attend a place of work will be tax deductible for individuals and exempt from fringe benefits tax from 1 July 2021. (substantiation requirements still apply here so keep your receipts)

- A single Paid Parental Leave scheme of up to 20 weeks paid leave will replace the existing system of 2 separate payments.

- The Government is expanding the Home Guarantee Scheme to make available 50,000 places per year, more than double the current number of places available to assist home buyers who have a lower deposit.

- First Home Super Save Scheme – From 1 July 2022, the maximum amount of voluntary contributions that can be released under the FHSSS will be increased from $30,000 to $50,000

Federal Budget 2022 for Business

Federal Budget 2022 for Business

In addition to the Technology Investment Boost and the Skills Investment Boost:

- Additional state and territory COVID-19 business support grant programs will be eligible for tax treatment as non-assessable non-exempt income until 30 June 2022.

- The Boosting Apprenticeship Commencements wage subsidy will be extended by 3 months.

- Concessional tax treatment will apply from 1 July 2022 for primary producers selling Australian Carbon Credit Units and biodiversity certificates.

- Access to employee share schemes in unlisted companies will be expanded reducing red tape and making it easier to compete globally for skilled employees.

- Business registry fees will be streamlined over 3 years from 2023–24.

Superannuation Drawdown

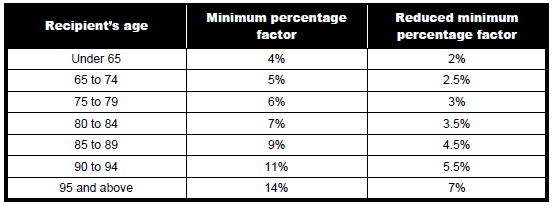

Account based pensions will be given a 50% reduction of the superannuation minimum drawdown requirements for an additional year.

Efficiency For Business

Efficiency For Business

- Companies will be able to choose to have their PAYG instalments calculated based on current financial performance, extracted from business accounting software, with some tax adjustments.

- Businesses will be allowed the option to report taxable payments reporting system data (via accounting software) on the same lodgement cycle as their activity statements.

- Trust and beneficiary income reporting and processing will be digitalised.

- IT infrastructure will be developed to allow the ATO to share single touch payroll data with state and territory revenue offices.

- The ATO will be given funding to extend the operation of the Tax Avoidance Taskforce by 2 years.

If you would like to understand more about how you can benefit based on your business’s circumstances, we would love to assist so get in touch.

Federal Budget 2022 for Business

Federal Budget 2022 for Business

Efficiency For Business

Efficiency For Business