Inactive Low-Balance Super Accounts

The latest super reforms explained

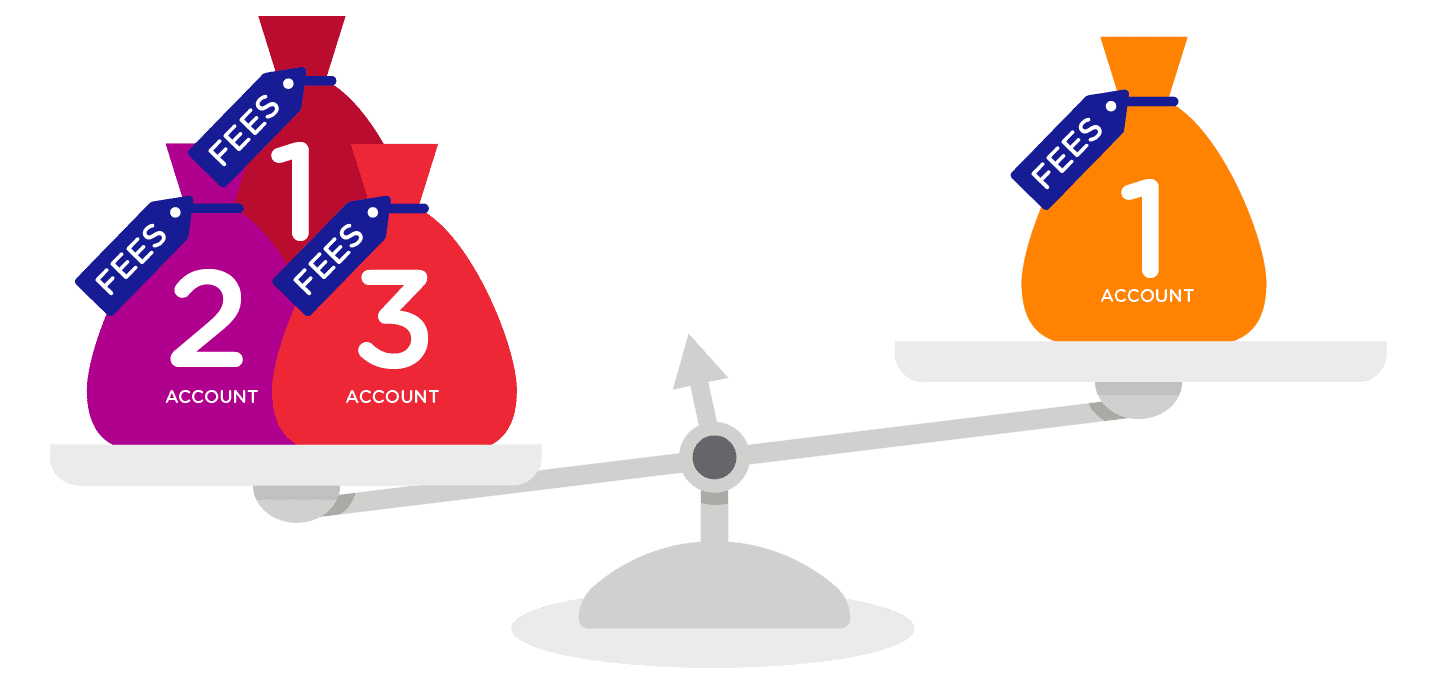

Superannuation members with multiple low-balance accounts, particularly those with automatic insurance cover attached to their account may be affected by new super laws.

Known as the Protecting Your Superannuation Package, the new legislation addresses concerns that people holding multiple low-balance accounts may be paying too many fees. From 1 July this year, the ATO will be able to consolidate member accounts that have a balance below $6,000 and haven’t received contributions in 16 months.

Inactive low-balance accounts

Generally, a super account is an inactive low-balance account if the following criteria are met:

- no amount has been received by your fund for crediting to that account for your benefit within the last 16 months

- the account balance is less than $6,000

- you have not met a prescribed condition of release

- the account is not a defined benefit account

- there is no insurance on the account

- the account is not held in a self-managed super fund (SMSF) or small Australian Prudential Regulation Authority (APRA) fund

This new legislation also means fund members risk losing their default insurance cover within their inactive super account.

Employees often end up with multiple inactive super accounts if a new employer opens a new account but forget to transfer the funds from their old one. The old accounts are no longer receiving contributions, but ongoing insurance premiums for default insurances continue to reduce account balances.

The new law will step in to ensure that this duplicate insurance is switched off. The Productivity Commission reporting this was costing $1.9 billion a year in excess insurance premiums.

It’s important to note if you have stopped contributing to your account for another reason (e.g. maternity leave) that you may lose insurance cover on 1 July 2019.

Superfund’s will not be considered to be inactive if any of the following apply:

- Your investment options have changed.

- Changes to your insurance coverage have been made.

- You have made or amended a binding beneficiary nomination.

- You’ve made a written declaration that you are not a member of an inactive low-balance account.

- there was an amount owed to the super provider in respect of you.

What You Need To Do

Super funds will be writing to members who are affected by the new requirements. Members are urged to find out if they hold insurance cover and whether the cover is appropriate for them.

Those who decide they should keep their cover have until 1 July to advise their super fund.

If you have an account that you do not want transferred to the ATO as an inactive low-balance account, you can:

- consolidate your super accounts using ATO online services through myGov

- contact your super fund for more information

- authorise your super fund to provide a written declaration to the ATO by completing a form and sending it to your super fund

The super reforms should help to ensure that Australia’s workers get the cover they need without paying for the services they don’t use.

If this raises any questions for you please contact us using the form below or by calling our office on (02) 43 53 2333

Three Things You Should Know About Super

If you found this article interesting you might like to read our blog on Three Things You Should Know About Super.