What is Payroll Tax NSW?

Payroll Tax has a long and colourful history in Australia. The federal government first introduced the tax in 1941 to fund a national scheme for child endowment. In 1971, the Federal Government passed Payroll Tax to the States. The uniformity of this tax has diminished over time, and currently State Payroll Taxes are levied at rates ranging between 4.75% and 6.85%.

The Current State of Play of Payroll Tax in NSW

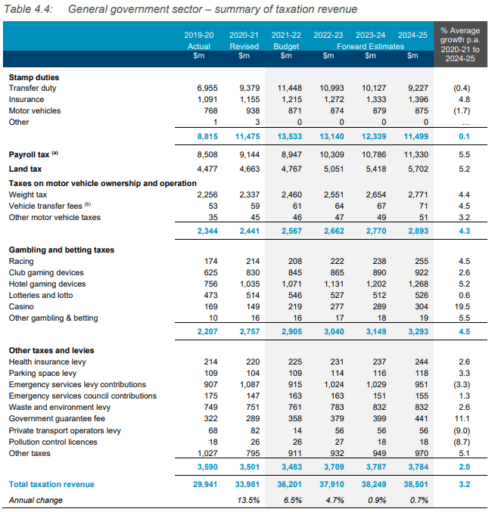

The current rate of Payroll Tax in NSW is 4.85%. The NSW 2021-22 budget shows forecast Payroll Tax collections at $8.9b, amounting to 25% of forecast tax collection in the state. As recently as FY 2020, Payroll Tax was the leading tax collected in NSW. However, in the past 12 months, Stamp Duty has exceeded this. The following is an extract from the NSW Government 2021-22 Budget Statement summarising NSW taxation revenue:

Source: NSW Budget Statement 2021-22 – Budget paper No. 1.

Does Payroll Tax Apply to My Business?

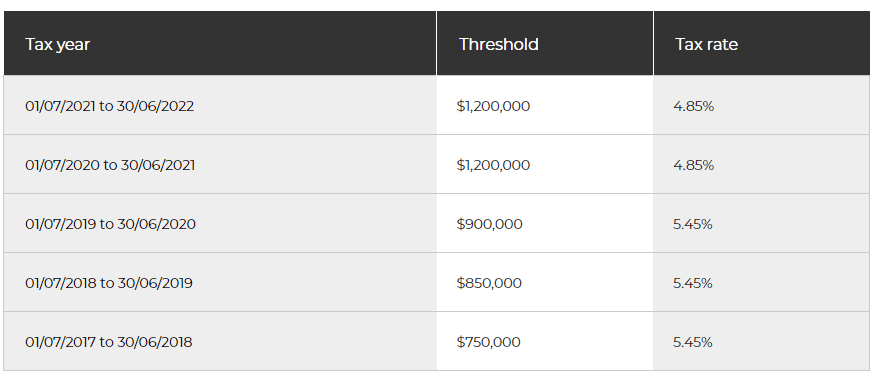

If your business employs staff and pays wages in NSW, you will be required to register for Payroll Tax if your Australian wages exceed the relevant monthly threshold. The annual thresholds determine the monthly threshold. The following is a summary of the historical Payroll Tax thresholds and rates in NSW:

Source: Rates and thresholds | Revenue NSW

What is Included in “Wages” For Payroll Tax?

You might think the definition of wages is straightforward, but this is not necessarily the case. For example, payments to employees employed on a permanent, temporary, or casual basis will be subject to Payroll Tax. In addition to this, payments made to certain contractors may also be deemed wages for Payroll Tax purposes.

Wages may include the following:

| Payment Type | Application on Payroll Tax |

| Allowances | Allowances paid to employees will be liable for payroll tax subject to exemptions for certain travel and living away from home allowances. |

| Bonuses & Commissions | These will be liable for payroll tax when paid to the employee. |

| Directors Fees | Fees paid to a director, including non-working directors, will be liable for payroll tax even if paid to someone other than the director. |

| Superannuation | All superannuation payments an employer makes on an employee’s behalf are considered “taxable wages” and are liable for payroll tax. |

| Fringe benefits | All taxable fringe benefits under the Fringe Benefits Tax Assessment Act 1986 are liable for payroll tax. However, if the benefit is exempt or has a zero value, it will not be liable for payroll tax. |

| Apprentice & Trainee Wages | As with other employees, all wages, including superannuation, paid to apprentices are subject to payroll tax. However, there is an opportunity to claim a rebate on wages paid to approved apprentices and new entrant trainees. |

| JobKeeper | In NSW, if you are an employer who made top-up payments to meet the Jobkeeper rate, there is an exemption from Payroll tax on these payments. However, other wages paid, payable to, or relating to the employee are taxable and not entitled to the exemption. |

| Salary Sacrifice | Payroll tax will be payable on the reduced salary paid to the employee plus any superannuation contributions (refer above) and FBT amounts on benefits subject to the salary sacrifice arrangement, such as motor vehicles. |

| Shares & Options | Where an employee is granted shares or options through an Employee Share Scheme, the value of this payment must be declared as wages for payroll tax purposes. |

| Termination payments | Eligible termination payments (ETP) to an employee will generally be liable for payroll tax. However, this is reduced by any income tax-exempt component included in the ETP. |

| Third-Party Payments | Where an employee or director provides services, all payments for these services are liable for payroll tax, regardless of who makes or receives the payments. |

What Wages, if Any, Are Exempt from Payroll Tax?

Some wages are exempt from Payroll Tax. These include:

- Additional wages paid to employees to meet the requirements of the JobKeeper scheme.

- Wages paid from 1 June 2020 funded by any payment made under the Commonwealth program, Aged Care Workforce Retention Grant Opportunity.

- Adoption and maternity leave.

- Paid parental leave.

- Contributions to redundancy benefit schemes.

- Wages paid to employees absent from work to volunteer as firefighters or respond to other emergencies.

- Wages paid to a person while on military leave as a member of the Defence Forces.

- Bonafide redundancy or early retirement payments.

Who is responsible for payroll tax in NSW?

Payroll tax liability is the responsibility of the employer. Any employer who pays wages in New South Wales that exceed the relevant monthly threshold must register for payroll tax. As of July 2020, the threshold for New South Wales payroll tax has stayed at $1.2 million.

How is Payroll Tax Calculated?

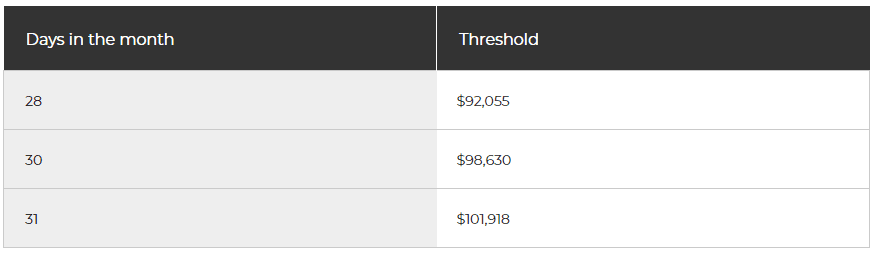

As mentioned above, the current threshold is $1.2 million, while the payroll tax rate sits at 4.85%. To calculate the monthly threshold for your NSW wages, the number of days in any given month is divided by the number of days in the year. This is then multiplied by the payroll tax threshold.

How much is payroll tax in Australia and how to pay it?

For employers who pay $6.5 million and below in taxable wages, the rate is currently 4.75%. Employers who pay above $6.5 million in taxable wages have a rate of 4.95%.

To pay your payroll; tax in NSW, there are several ways including online, in person and by post. Here are some of the most common ways to pay your balance.

- Electronic Funds Transfer (EFT)

- Pay by BPAY

- Pay at Australia Post

- Make payment by mail

- Pay by direct debit

- Pay via telephone

- Pay by credit card

- Pay by Overseas EFT

- Setup instalments

What About Interstate Wages?

Wages your business pays to interstate-based employees will generally be subject to Payroll Tax. If your company pays interstate wages, you can’t claim the total Payroll Tax threshold deduction in NSW. Your available threshold is reduced based on the quantum of your interstate wages.

Grouping for Payroll Tax Purposes?

Grouping of businesses for Payroll Tax purposes can be done for a variety of reasons. However, the most common reasons for grouping businesses include:

- Related companies – Grouping companies or businesses for Payroll tax purposes occurs if they meet the definition of related companies under the Corporations Act 2001. This will apply even if the companies have an overseas holding company

- Common employees – Grouping may apply where one or more business employees perform services under an arrangement between multiple employers.

- Common control – When a situation arises where an individual or group of individuals have a controlling interest in multiple businesses, those businesses will be grouped for payroll tax purposes. The definition of controlling interest depends on the legal structure of the businesses involved.

Will My Business be Audited?

It is critical you understand your obligations when it comes to reporting your Payroll Tax obligations. The system is based on voluntary self-assessment. Audited businesses who are found with a tax shortfall will be subject to penalties and interest on the Payroll Tax shortfall. In addition, the NSW Government works closely with the ATO to share information and data concerning wages and FBT. This data is matched to the information contained in Payroll Tax returns.

The NSW Government has been auditing Payroll Tax compliance in the 2020-21 financial year. The results of this compliance program are summarised below

- Audited 1,623 registered Payroll Tax customers and identified $159.1 million in additional Payroll Tax.

- Lodgement enforcement activity was undertaken on 2,860 customers and identified over $55 million in compliance revenue.

- Investigated over 685 unregistered businesses with undeclared liabilities, assessed 94% of these and recovered over $24.3 million in the additional payroll tax – 252 of these businesses were informed of their potential obligations and assisted in getting their assessments right the first time without penalty.

From this, we would encourage you to make sure you are reporting your Payroll Tax correctly to avoid being caught out. If you need assistance with Payroll Tax speak with a professional advisor or contact us at Bishop Collins Accountants.