Occupational Fraud – Cooking The books

As a business owner, have you experienced Occupational Fraud yet? If you answered yes, we are not surprised. If you haven’t, there’s a chance it won’t be long until you do.

Occupational Fraud relates to fraud committed by individuals against the organisation that employs them. In other words, by employees to employers.

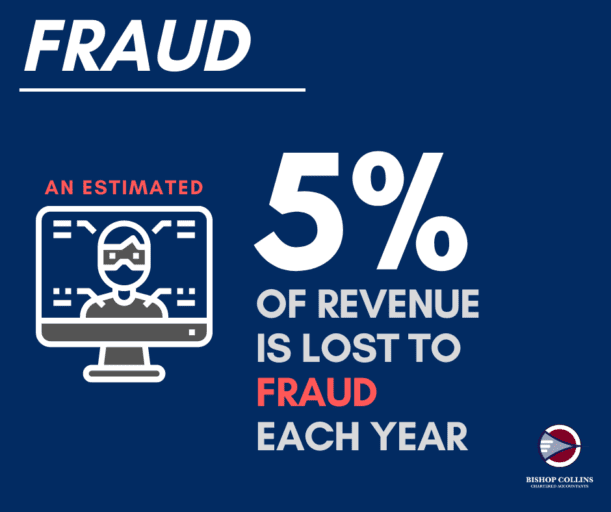

The prevalence of fraud, in any size organisation, is far more common than you would expect. In fact, most business owners underestimate the risk of fraud occurring in their business.

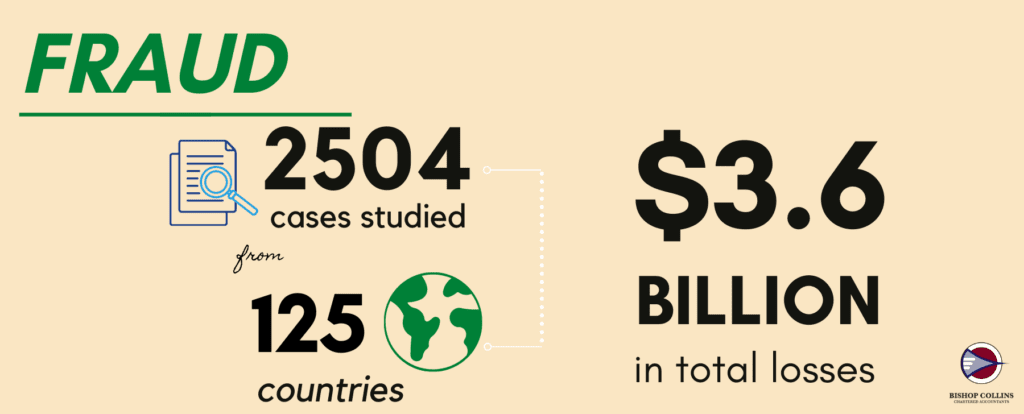

The Association of Certified Fraud Examiners (ACFE) recently released it’s 2020 Global Report to the Nations on Occupational Fraud. Shockingly, it reveals that across all sizes of organisations (based on the number of employees), the number of cases of fraud reported was evenly distributed. This means the occurrence of fraud in small to medium-sized businesses is the same as in large businesses. Small businesses (less than 100 employees) had the highest median loss of USD $150,000. However, despite larger organisations (more than 100 people) reporting a median loss of a similar amount (USD $140,000), the impact of this loss on a small business would be felt much harder than on the larger organisation.

These statistics highlight that if you think your business is too small to be hit by fraud, you are mistaken.

What is the most common type of fraud?

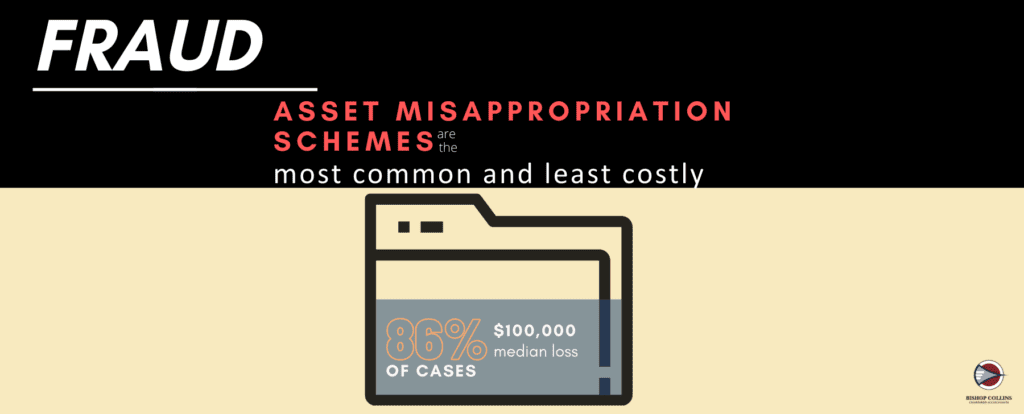

Among the various types of fraud to be aware of the 3 most common in all organisation sizes are:

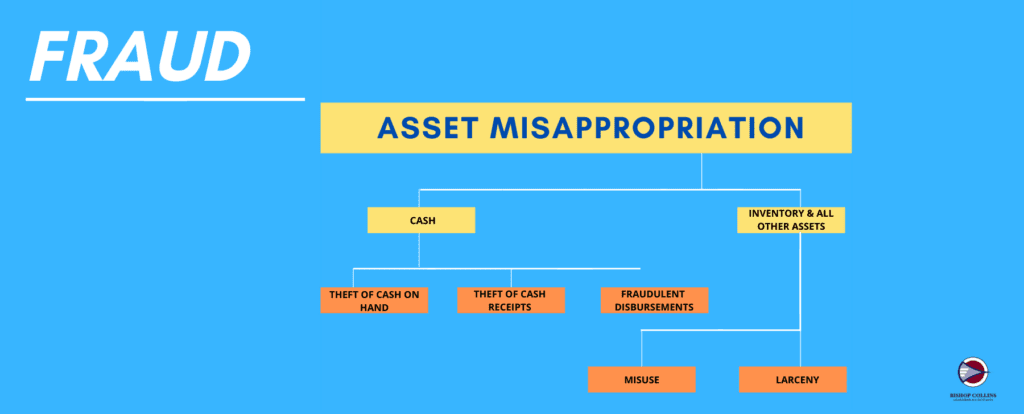

- Asset Misappropriation (eg. Theft, fraudulent disbursements etc)

- Corruption (eg. Conflicts of interest, bribery)

- Financial Statement Fraud (eg. Fake revenues, understated liabilities, improper valuations)

Although 86% of cases were due to Asset Misappropriation, this method had the smallest median loss of USD $100,000. Whereas Financial Statement Fraud occurred only in 10% of cases but showed a staggering median loss of USD $974,000.

Most interestingly in one-third of cases the fraudster committed more than one of these primary categories of Occupational Fraud.

What are the warning signs of those who commit organisational fraud?

It is important to note that the ACFE report says fraud perpetrators displayed at least one behavioural red flag in 85% of cases, and multiple red flags were present in 49% of all cases.

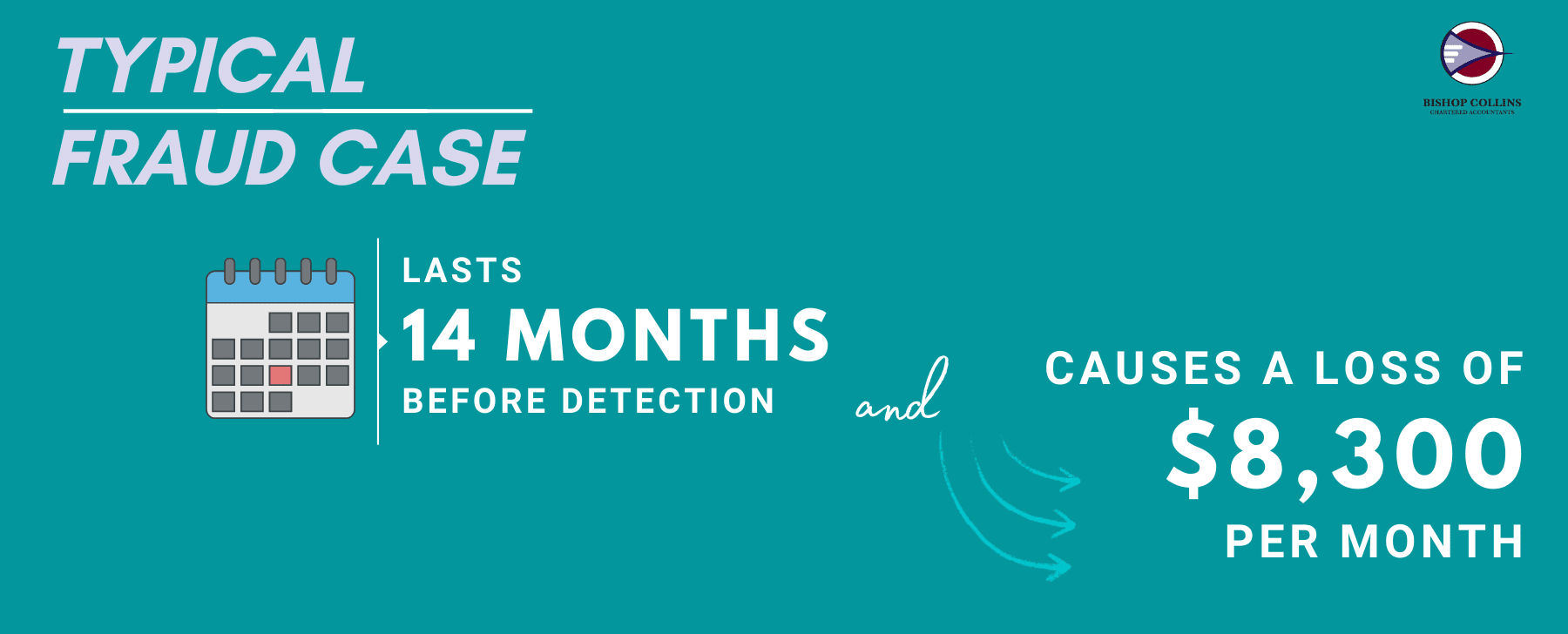

The typical fraud scheme lasts 14 months before it’s detected; during this time, the perpetrator will often display certain behavioural traits that tend to be associated with fraudulent conduct.

The 10 most common red flags were:

- Living beyond their means 42 %

- Financial difficulties 26%

- Unusually close association with vendor/customer 19%

- Control issues, unwillingness to share duties 15%

- Irritability, suspiciousness, or defensiveness 13%

- “wheeler and dealer” attitude 13%

- Divorce family problems 12%

- Addiction problems 9%

- Complain about inadequate pay 8%

- Refusal to take vacations 7%

Characteristics of organisations that are victims to occupational fraud

Most businesses simply don’t think it will happen to them and therefore don’t have the right processes set up to detect fraud.

Small to medium business owners spend a lot of time building relationships with their employees. Often, they like their employees to feel like a part of a family, making it harder for employees and employers to call out any sinister behaviours. It’s also common for small to medium business to have only one person who performs lots of roles, allowing things to go unnoticed.

The ACFE report highlights that private companies hold the highest instances of being victims of fraud (44%) with a shared median loss of $150,000 with that of public companies who come in at second place with 26% of all cases.

Not for Profit organisations were also identified as being highly susceptible to fraud due to having limitations on resources available to prevent and recover from fraud losses (N.B. Bishop Collins are industry specialists in the NFP sector, so please consider reaching out to us if you think you may need an independent review of your NFP). The top 3 control weaknesses were:

- 35% lack of internal controls

- 19% had an absence of management review

- 14% override of existing internal controls

Characteristics of the perpetrators within the workplace

Most occupational frauds are committed by employee level (41%) or manager level staff (35%). But frauds committed by owners/ executives (20%) are much more harmful, with a median loss of $600,000. A look into the perpetrators revealed the following stats:

- From the above stats, this reaffirms that owners/executives are in a better position to override controls than their lower counterparts, and often have greater access to assets of the organisation. Meaning internal control processes need to be continually reviewed independently.

- The longer a fraudster has worked for the organisation the more damage that a person’s scheme is likely to cost the company. Those who had been with the company for more than 10 years committed 23% of fraud cases and cost the company a median loss of $200,000. While those who had only been with the company for less than 1 year made up only 9% of cases and came in at a cost of $50,000 to the company.

- Interestingly the highest percentage of fraud cases were committed by those who had been with the company between 1 and 5 years. Making up 46% of cases and costing the organisation a median loss of $100,000.

- The stats tell us that longer tenured fraudsters do not steal more because of their level of authority, but rather their added level of experience with their organisations seems to improve their skills or abilities related to committing fraud.

- Executives and upper management, along with accounting and finance departments, represented the highest frequency and median loss. This reaffirms the view these areas should be carefully reviewed and addressed in an independent anti-fraud program.

- As in past studies, male staff far outweighed their female counterparts in both the number of cases (72% to 28%) and median loss ($150k to $80k).

- The age of the perpetrator represented a bell curve, in that 53% of fraudsters were between the ages of 31 and 51. Interestingly, whilst this group had losses ranging from between $80k and $141k, those aged 56 and above caused a median loss of between $400k and $575k despite having less than 10% of cases.

How do you prevent occupational fraud in your organisation?

Detection is very important because the speed with which fraud is detected can have a significant impact on the size of the fraud. It’s also the key to prevention because organisations can take steps to improve HOW they detect fraud, which in turn increase their staff’s perception that fraud WILL be detected and may help deter future misconduct.

As in previous studies by the ACFE tip-offs were the most effective form of detection. More than 40% of cases were uncovered by tips. Therefore the processes to cultivate and thoroughly evaluate tip-offs by employees should be a priority to organisations.

The next highest detection method was an internal audit, followed by a management review. These three detection methods are classed as proactive methods. Meaning that the organisation has actively taken steps to improve their processes and internal controls to proactively detect fraud. Proactively detected fraud tends to be detected more quickly and thus causing fewer losses than passively detected (meaning the fraud came to the victim’s attention through no effort of their own, e.g. By police, by accident or confession) which resulted in lengthier schemes and increased financial harm to the victim.

Anti-fraud controls such as account reconciliation, internal audits, management reviews and active cultivation of tips are all very effective methods to detect and therefore prevent fraud.

Bishop Collins are members of the ACFE, and we can offer your organisation an independent internal audit to assist you in detecting any sinister behaviours which may have gone unnoticed. Once again, we can’t stress enough how many times we uncover fraud in an organisation that had no idea of it happening.

Please consider this article carefully and reach out to us if you have not had your internal control systems and processes reviewed recently or if you think your organisation could benefit from an independent review. You can contact us on (02) 4353 2333 or complete the contact form on this page.

Download our top 7 “common sense” tasks that often get overlooked or put off, that can help your organisation prevent fraud.