Your superannuation takes a journey of many years, accessing your superannuation early is not usually something intended as part of this journey. Your superannuation savings will face many trials and tests during its journey, and even further challenges once you reach retirement. Accessing your superannuation early can have many consequences.

So what are the impacts of accessing your superannuation early?

The government’s announcement allowing Australians to participate in the “coronavirus early release of super” , meaning you are able to access your superannuation early, was met with an overwhelming response. Within 18 days, 745,000 people had registered via MyGov to access their superannuation early.

The Government estimates 1.6 million people will be accessing their superannuation early, withdrawing a staggering total of $27 billion from superannuation savings. The Australian superannuation industry believes this number will in fact be closer to $65 billion.

Urging caution when accessing your superannuation early

We would like to take this opportunity to urge caution when considering accessing your superannuation early. Depending on your age, a withdrawal of $20,000 from your superannuation may have a devastating impact on your superannuation balance at retirement.

Based on an annual net return of approximately 5%, we estimate the reduction in superannuation balance at a retirement age of 67, by withdrawing $20,000, may look something like this:

| Current Age | 20 | 30 | 40 |

50 |

60 |

| Reduction in retirement balance | $ 195,000 | $120,000 | $75,000 | $ 45,000 | $28,500 |

| Reduction in annual retirement income | $ 9,900 | $ 6,050 | $3,800 | $2,300 | $1,400 |

Further limitations when accessing your superannuation early

Investment returns may be further diminished from a smaller superannuation balance where you need to cover ongoing insurance premiums. By accessing your superannuation early, withdrawing the funds for your retirement, you will also miss out on the significant taxation benefits of saving in the superannuation environment. Future legislative changes may also restrict your ability to ever be able to put the money back into superannuation.

Rather than withdrawing $20,000 from your superannuation, we suggest you consider alternative methods to manage your cash flow as part of the current crisis. This may include accessing your entitlement to government payments and discussing deferral of debt payments with your lenders.

We have covered all of the stimulus packages in a webinar. You can watch and listen to this webinar to see what alternatives are available from the Government, the ATO and the ABA, to accessing your superannuation early. You can access this via this link: Manage the impacts of COVID-19

In addition to this, we suggest you consider adding to your superannuation on a regular basis if your cash flow permits now or in the future. For as little as the price of a cup of coffee per day, an increase in superannuation contributions can have a significant impact on your retirement savings. This is illustrated in the case study below.

Case Study

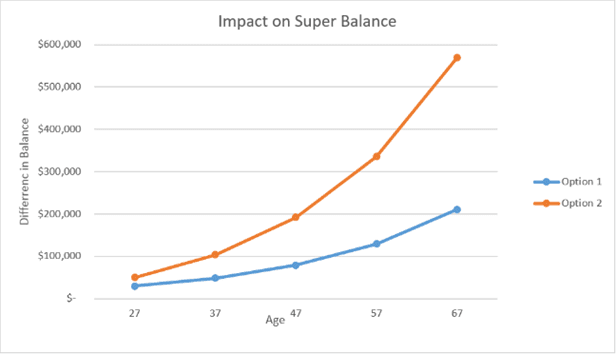

Tony is currently 27 years of age and has a superannuation balance of $50,000. He is considering whether he should withdraw $20,000 from superannuation (option 1) even though he does not desperately need the cash at this time. After speaking with his financial advisor, Tony considered not withdrawing the $20,000 plus contributing a further $5 per day into superannuation ($1,800 per annum) (Option 2).

The following chart shows the difference in Tony’s superannuation balance between option 1 and option 2 when he retires.

By selecting Option 2, Tony will have more than $350,000 extra in his superannuation account on retirement than if he selected Option 1.

The above example shows it is never too early to learn how your superannuation can work for you, so that you can maintain your lifestyle in your retirement.

Should you require support with your superannuation savings journey, or to navigate through the requirements to access your entitlement to government incentive payments, or to discuss if you should be accessing your superannuation early, please contact us at Bishop Collins on (02) 4353 2333.

For more information on alternatives to accessing your superannuation early, you can read the following articles, however the webinar link above will provide the most up to date information for you:

Instant Asset Write Off and Help with Apprentices and Trainees

DISCLAIMER – This information was prepared for discussion purposes only and should not be relied upon for decision-making. You should consult your professional financial advisor if you require additional information. This information has been prepared by Bishop Collins Wealth Management Pty Ltd an Authorised Representative of Primestock Securities Ltd