Martin Le Marchant

Director Audit

A financial audit is an independent examination of a company’s financial records and statements to ensure their accuracy, completeness, and compliance with accounting standards and regulations. Preparing for a financial audit can be a daunting task, but it’s crucial to ensure the integrity of financial information and to avoid potential legal and financial penalties. In this blog, we will provide tips and advice on how to prepare for a financial audit, including understanding the purpose of a financial audit, steps to prepare for one, and common financial audit findings and how to avoid them.

An audit should not fill you with dread. Preparing for an audit of your financial statements, when properly planned, can save your organisation time and money. An audit doesn’t have to disrupt your business: it can effortlessly form part of your operational processes and not impose many additional demands on your resources.

Understanding the Purpose of a Financial Audit

The primary purpose of a financial audit is to provide assurance that a company’s financial statements are accurate and complete. The auditor examines the financial records and statements to ensure that they are free from material misstatements and errors. The audit also evaluates the company’s internal control system to ensure that it is effective in preventing and detecting fraud and errors.

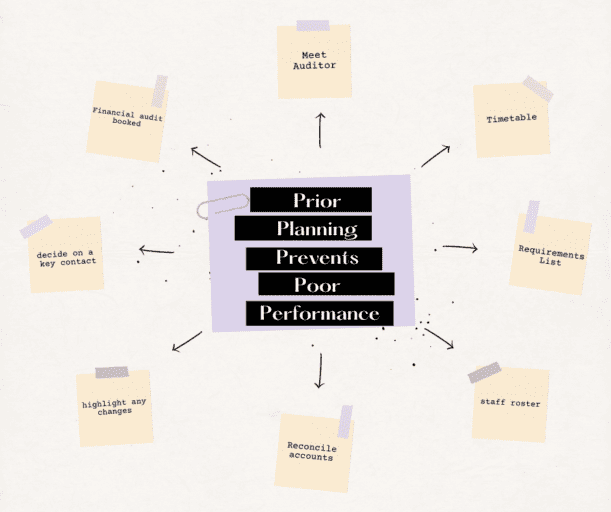

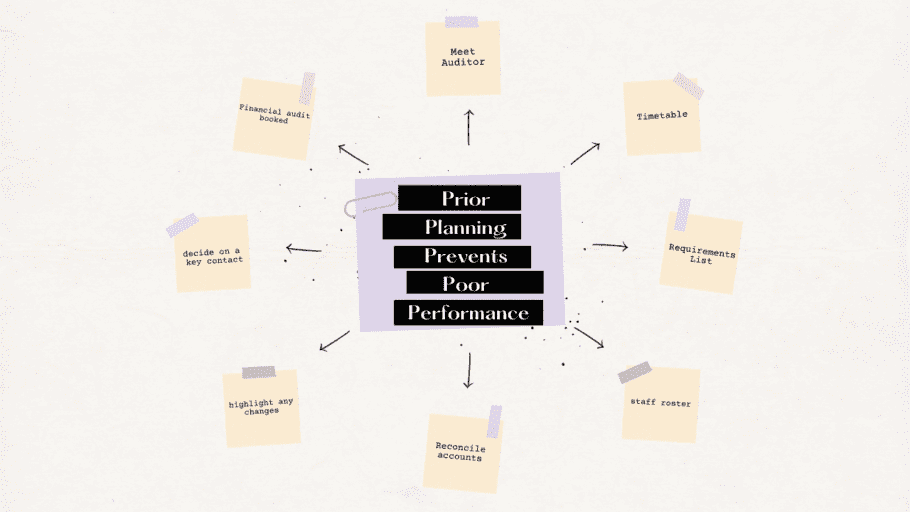

Key points to consider in preparing for an audit of your financial statements include:

Steps to Prepare for a Financial Audit

The preparation for an audit is essential to achieving success, as it prevents poor performance from occurring. Preparing for a financial audit can be a time-consuming process, but it’s essential to ensure that the audit goes smoothly and efficiently. Here are some steps you can take to prepare for a financial audit:

- Meet with the auditor early. Outline key changes in your business, significant or unusual transactions, and matters which might have a bearing on the audit – this includes breakdowns in internal control, fraud, and legal or insurance matters. By addressing matters early, relevant documentation can be maintained and reviewed when it is top-of-mind.

- Establish a timetable of key deadlines and dates (e.g. information delivery, Board and committee meetings, annual general meetings, etc.). As part of the audit process, progressive deadlines should be established to focus everyone’s efforts.

- The auditor might also provide a detailed list of requirements to facilitate the audit process. This is sometimes called a “Requirements List” or “Assistance Schedule”. It includes documents the auditor will likely need to complete the audit of your financial statements. If you don’t receive one, certainly ask for it! Plan to have everything prepared and ready prior to the audit commencing.

- Try to avoid any key staff scheduling time off during and right after the audit. As noted earlier, whilst supporting work papers and information will have been requested by the auditors prior to the start of audit fieldwork, throughout the audit of your financial statements the auditors will often be asking for additional information. This information includes supporting documents and explanations. In our experience, scheduling brief status meetings and maintaining a joint ‘outstanding list’ assists with managing progress and makes sure everyone is always on the same page throughout the audit. Some of your key staff members may be needed for this process.

Ensure Accounts are Reconciled before an Audit of Your Financial Statements

Reconciliations should be completed regularly and completely. For many organisations, this occurs monthly. For certain regulated entities, this might include daily and weekly reconciliations of accounts. Through regular reconciliation of accounts, potential issues are likely to come to the forefront. Sometimes, new or unusual transactions present technical accounting and disclosure considerations. These can then be discussed and resolved before the audit gets underway.

For example, you should make sure that:

- Cash balances reconcile to your bank statement.

- Loan balances agree to loan statements.

- Fixed assets, debtors, and creditor balances tie to sub ledger reports.

- Liability estimates agree to accrual calculations or supplier invoices received.

- Employee benefit liabilities (e.g. annual leave, long service leave) have been calculated with reference to prevailing employment conditions and requirements.

- Importantly, key estimates and assumptions should be supported with considered documentation or empirical evidence.

Identify Significant Changes which may Affect the Process of your Financial Audit

Has your organisation’s financial situation changed from last year? Are there new lines of business or investments in new projects? Has there been tremendous revenue growth or expenditure? With the recent health pandemic COVID_19, many organisations were affected in different ways. This also includes consideration of grants or government support your organisation has received.

It’s also important to note any non-financial changes that have occurred in the company. Auditors consider the organisation’s internal control environment in completing the audit.

- Have internal controls changed,

- Have systems been introduced or amended, and

- Were there any changes to key employees?

It’s also helpful to let your auditor know of any important events that have occurred within or to the organisation. These events might have happened during the year or after year-end. The latter is usually referred to as “subsequent events”. These events usually need to be disclosed in the financial report and extend up until the financial report is “signed off”. Some common events to consider are:

- Opening or closing a line of business

- Acquiring or divesting a company or other significant asset

- A damaging fire in an existing location

- Signing significant contracts (e.g. acquisition of property)

- Legal disputes and claims

- Negotiating new debt terms

- Breaches in loan covenants

- New capital investment from investors

Designate a Key Contact in the Preparation of Financial Audit

As they say, too many chefs spoil the broth. Whilst the finance and audit teams must work well together, in an age of technology and information overload there can be a tendency for things to be lost in translation and potentially lose sight of the end goal.

It’s helpful to designate one central point of contact between each team. This person will be responsible for directing and delegating all questions to the appropriate internal teams, making sure those questions get answered in an efficient and effective manner.

Professional Development and Training

Accounting standards and legal and regulatory requirements are frequently updated. It’s important the finance team is familiar with new accounting and compliance developments instituted by regulatory bodies (for example, the Australian Accounting Standards Board, the Australian Securities and Investments Commission etc.). Also, be sure to assess whether internal accounting staff require any additional training or information to implement the new requirements.

Ask Questions About your Financial Audit

If you don’t understand an item requested by your auditor or a part of the audit process, your auditor should be happy to answer any questions.

If your auditors ask a question that you don’t have a response to, take the time to discuss the issue with them and ask how you can help find the answer. Postponing these issues only delays the audit process and hinders your chances of having a successful audit. Addressing issues as they arise avoids being buried beneath mounting stress and rapidly approaching deadlines.

Learn from the experience

The financial audit process is an evolving one,

- Reflect on what you’ve learned during the process.

- Review the recommendations raised by the auditor, as well as the proposed and actual adjustments identified in the audit:

These are opportunities to further improve. Equally, don’t be afraid to share feedback with the auditor on their audit process – what worked well, and what didn’t. Learning is a two-way street, after all.

If you have thought about having a financial audit conducted at your organisation or you just want to know more about what it would mean for your business, organisation, or entity to have an audit on your financial statements please contact me and have a chat.