The Balance Sheet – The Forgotten Sibling

In my experience working with clients and their businesses for the past 30 years I believe the balance sheet must have an inferiority complex. Adulation is thrown at its siblings the profit & loss and the cash flow statement, but the balance sheet barely rates a mention!

There is so much fuss and attention paid to net profit, EBITDA, and cash flow from earnings. Many small to medium business owners often don’t even think about their business’s “lost child”, the balance sheet.

Ignore the Balance Sheet at Your Peril

Financial disasters will generally reside in a business’s balance sheet. This is where the risk lives and it will always be a sick balance sheet that brings your business unstuck. I’m sure you’ve heard the expression “show me the money”. It’s the balance sheet that will respond to this request not the profit and loss.

As a small business owner, being adept at interpreting your balance sheet will allow you to make the most informed decisions in the best interests of the long-term health of your business.

It’s About the Destination not the Journey

The balance sheet is the final destination of your business at any point in time. The profit & loss and cash flow statement show the journey to arrive at that destination. We would all prefer to have a poor journey and arrive at a fantastic destination, rather than a great journey to arrive at a terrible destination.

This is no different in business. You have worked hard to build your business and you want to have something of value at the end. Whether your aim is to sell the business for retirement or pass the business onto the next generation. The value of your business resides on its balance sheet.

Balance Sheet Examples: Failures

The following are real life balance sheet examples, which have suffered (either failed or close to it) because the management was focused solely on profits and did not pay attention to the balance sheet of the business:

| Issue | Outcome |

| Short term finance against long term asset | One key lesson from the pandemic is do not mismatch assets and liabilities. Due to changes in the economic cycle the bank was unable to refinance the business debt, and the owner was forced to sell the property the business owned in a depressed market. This not only crystalised a loss on the property investment it forced the owner to move the business to new premises at significant cost. |

| Liquidity risk | Insufficient working capital in a business meant the business was always relying on current or future sales and deferral of creditors to cover costs. When the business had a bad trading month it could not pay employees (who will never agree to deferred payment terms) and the doors closed! |

| No access to credit | A medium sized business did not put a credit facility (overdraft) in place while it was trading well. As a result of a couple of bad trading months it had insufficient cash available to pay key suppliers and staff. It had to rely on the goodwill of key suppliers and the ATO to defer payments to make wage payments. |

| Impaired accounts receivable | As a result of poor credit risk assessment processes, a business continued to sell to a customer in financial difficulty. While the profit looked great off the back of all these sales, once the debt went bad the business became insolvent. |

| Obsolete Inventory | A business was carrying a significant amount of inventory which had declined in value due to new competition in the marketplace. The business owner did not consider their balance sheet inventory values and after several years the owner realised this inventory could only be sold below cost. |

| Income in advance | A construction business was taking deposits in advance without providing for the corresponding costs to deliver this service on their balance sheet. It relied on new customer deposits to cover costs for previous projects, effectively resembling a Ponzi scheme. This business soon came to an end in the current Australian construction industry environment. |

Prepare a Balance Sheet Forecast

Businesses that produce forecasts generally only forecast the profit & loss. By creating a balance sheet forecast, and comparing it to actual each month, many of the above tragic business outcomes may have been avoided.

A balance sheet forecast allows the business operator to see the cash flow “pinch points” in advance and enables the owner to take the appropriate corrective action before it is too late. At a minimum you should have your bookkeeper or accountant prepare a month-by-month annual balance sheet forecast for your business. Then each month report the actual vs forecast balance sheet and take the time to interpret the outcomes which will allow you to understand the health of your business. This will take a lot of the guesswork out of strategic decisions for your business.

Once you have this forecast you can then work with your bookkeeper or accountant and play with the document to see into the future how strategic business decisions may impact the financial health of your business.

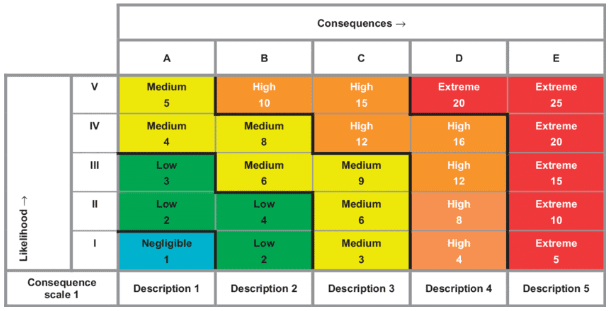

This is called sensitivity analysis and it allows you to understand how “sensitive” your business is to changes in trading conditions. Having a balance sheet forecast will support you in making key decisions for your business in the following areas:

- New staff hires to expand your business.

- Buying bulk inventory in advance at a discount.

- Short term reduction in prices to remain competitive.

- Financing new equipment via debt or from business cash flow.

- Business acquisitions and mergers.

- Restructuring your business to wind up a poor performing product line or division.

- Level of dividends to pay to business owners.

These are all critical decisions you will need to make at some time during the course of managing your business. Without a balance sheet forecast you will be making these decisions based on “the vibe” rather than on data which is critical to allow you to make an informed decision.

Speak to Bishop Collins about Balance Sheets

If you’re curious to learn more about balance sheets or bookkeeping in general, then give the team at Bishop Collins a call. Our expert team are specialists when it comes to small business bookkeeping, and our staff stand ready to assist you.

To learn how Bishop Collins can help you with your balance sheets, visit bishopcollins.com.au or call (02) 4353 2333.

When you are preparing your tax documents for your accountant or lodging anything with the ATO, make sure you are paying attention! Of course, everyone makes mistakes from time to time; however a mistake on your tax can be costly – especially now, as the ATO moves out of their COVID “

When you are preparing your tax documents for your accountant or lodging anything with the ATO, make sure you are paying attention! Of course, everyone makes mistakes from time to time; however a mistake on your tax can be costly – especially now, as the ATO moves out of their COVID “

Some of us have not experienced the burden of an ATO tax audit – those who have are generally more careful about taking the time to understand what they need to report in their tax returns. Most accountants have audit insurance offerings which can help cover professional fees through the uncomfortable process, however, this insurance doesn’t pay for penalties or increases in tax should a mistake be found. It also doesn’t reduce the likelihood of an audit. If you do find yourself in the unfortunate situation of an ATO audit, having a professional assisting you is highly advisable and does increase your chance of a more favorable outcome with the ATO as your accountant can professionally direct your responses and assist in defending your reported position. It is worth noting however that the most effective insurance you can have is to be proactive and not complacent about your income tax

Some of us have not experienced the burden of an ATO tax audit – those who have are generally more careful about taking the time to understand what they need to report in their tax returns. Most accountants have audit insurance offerings which can help cover professional fees through the uncomfortable process, however, this insurance doesn’t pay for penalties or increases in tax should a mistake be found. It also doesn’t reduce the likelihood of an audit. If you do find yourself in the unfortunate situation of an ATO audit, having a professional assisting you is highly advisable and does increase your chance of a more favorable outcome with the ATO as your accountant can professionally direct your responses and assist in defending your reported position. It is worth noting however that the most effective insurance you can have is to be proactive and not complacent about your income tax