Reserve Bank of Australia: Interest Rates up by 0.5%

By now you would be aware of the latest news that the Australian reserve bank interest rates are on the rise, with the Reserve Bank of Australia (RBA) announcing that interest rates would rise by half a per cent to 0.85 per cent. The Reserve Bank of Australia’s 50 basis point interest rate rise to the cash rate was bigger than expected.

So, what does this mean for you?

You may know by now that my articles tend to take the positive and opportunistic side of events and this one on interest rates news will be no different.

When interest rates increase, it is always met by the fear side of the argument that Cost-of-Living pressures will increase and we will enter a cost of living crisis. However, what is the brighter side or the opportunistic side to this current interest rate rise and potential future interest rate increases?

Quantitative Easing QE

Cheap money known as Quantitative Easing QE has occurred in various countries around the world starting in Dec 2008 in the US known as QE1.

Quantitative easing is a way for the government to increase how much money is available in the economy. When the Reserve Bank thinks that interest rates are too low and economic growth is too weak, it will use quantitative easing to try and change that. This usually means printing more money. There are some risks with this policy, like inflation and things getting too expensive, but so far, the Reserve Bank has been able to handle those risks well.

Australia was late to follow suit with the US and various other countries but did so in 2020 following the challenges of COVID. This flush of cash provided cheap money, keeping interest rates low.

Interest rate news: The news of low interest rates however has some side effects.

Firstly, cheap money can create lazy investment and high risk taking. If you are getting cheap money, you are willing to take a greater risk. This arguably leads to an inefficient use of capital.

By bringing the interest rate into more appropriate settings we are valuing the cost of capital and bringing balance back into the system. Less risk taking, more reward to the holders of capital and encouragement to focus on efficiency gains rather than a quick win.

Secondly there are many people that rely on higher interest rates for their income.

For example, those in retirement that have had their nest eggs reduced by lower interest rates over the last decade will see some welcome relief in a higher interest rate environment.

There are two things we talk about when we talk about the economy or businesses: capital and labour. We all know that wages need to go up because of inflation. Well, the same goes for capital. If I have $100,000 in a bank account that pays 1% interest but inflation is 5.1%, then my money is losing value each year. So, an increase in the interest rate rewards people who have money saved (capital), just like a wage increase rewards people who work hard (labour).

Finally, an increase in the interest rate means that demand will be constrained and why this can be good is that it should aim to relieve inflationary pressures already very hot in the economy.

For us at Bishop Collins we also focus on encouraging our clients to search out for the best interest rate they can get of their home loan and other loans. Utilise resources effectively and look at future investment structures more cautiously now.

What are your opportunities on structure?

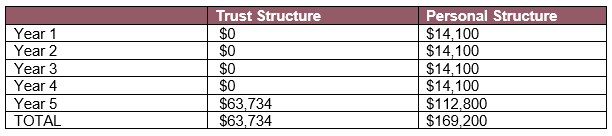

Negative gearing will now be a greater consideration in our financial analysis. With higher interest rates property investments are going to return less than before and so how an investment property is structured needs to be considered more carefully. Is the property held in a High Income earners name to make use of the negative gearing, Or is it better in a Trust Structure ? These are the considerations you must take more care and attention to consider and calculate the various options.

Please contact one of your Bishop Collins advisors to gain some further insight and take advantage of a changing environment.

Federal Budget 2022 for Business

Federal Budget 2022 for Business

Efficiency For Business

Efficiency For Business